There are three credit reporting bureaus, who track your available credit, credit usage, payments , history and provide you with a Credit Score, they are Equifax, Experian and TransUnion.

The two credit score models widely tracked are FICO (offered by Fair Isaac Corporation) and VantageScore (created by the three credit bureaus). Fair Isaac & Company was founded in the late 1950s; FICO scores and a standardized algorithm were introduced in the late 1980s. VantageScore was developed in 2006 by a collaborative effort of the three credit reporting agencies.

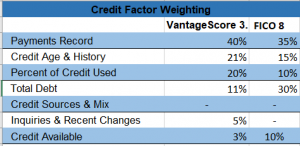

Similar but different is the conclusion when comparing VantageScore and FICO. There are multiple versions of each score. The most popular models used are FICO 8 and the all new VantageScore 3.0, which ACUTRAQ Background Screening uses. With the introduction of VantageScore 3.0 in 2013 both models return scores using a range of 300-850. As their algorithms differ “good” credit scores are generally considered 670+ for FICO and 700+ for VantageScore. VantageScore prefers not to use percentages to describe how much weight it gives various credit factors, as FICO does, but instead describes them in terms of influence, but for the sake of this blog lets do 😉

You may garner a VantageScore before a FICO score as the former only requires one month of credit history versus six months for FICO. Payments are the largest factor for each score. Payments of credit bills and other debt are tracked by the bureaus. Utility and service payments have not traditionally been reported to the credit bureaus. Poor mortgage payment performance is weighted more heavily than other payments by VantageScore.

Credit inquiries are companies checking your credit worthiness to issue a loan or new credit card, affect your score. Repeated attempts to garner credit cards or loans have a negative impact on scores. VantageScore will group all inquiries during a 14-day period as a single inquiry. FICO groups inquiries by 45-day increments.

Do you have low or ok credit and you want to take it to the next level? Are you young or you have been living on cash? Do You want to establish credit and history? You have poor credit and your scores need help?

First, there is no quick fix. Availing yourself to professional services (credit counselors and/or online tracking services) is one strategy which may be appropriate particularly if you feel overwhelmed. There are in fact some NON-PROFIT entities that will help you do that. Be careful with the ones who say they can give you a “QUICK FIX” on your credit score. For the time being, according to Money, as part of its response to COVID-19 that consumers will be able to request a free credit report from all three reporting bureaus once a week, with no negative effect on credit scores, for a one year period.

FAIR Credit Score

You have a “fair” credit score and you want to purchase a home or rent a house. Talk to your broker and ask them to sign up ACUTRAQ Background Screening Inc., We are able to do a “soft” inquiry on your credit. That is an inquiry which does not impact your score. If you haven’t gotten your score in 12 months annualcreditreport.com can give it to you for free. Beware of companies like Credit Karma and others who advertise “FREE” credit reports. They are either not free in the end or give you scores you cannot count on as being right. A reputable company may inform you if you qualify or how far away you are on your score.

Need Help? Where to start

You can help your score by closing department store, gas station or other credit cards you rarely use. Make timely, payments on all cards and other debt you maintain. Make sure your total debt is reducing. Making minimum monthly payments is like treading water; you cannot do it forever and it is costing you a fortune. That is the way credit cards make their money, by charging exorbitant interest charges. You will NEVER get ahead by making just the monthly minimum payments. That is what the credit card companies hope you will do.

If you’re new to the credit world, sure you have an ATM card but you may be asking yourself “how do I get a “good” credit score”. Start small. Talk to your bank about credit cards they offer. Review online credit card offers for establishing credit. Once you have secured a card with a modest credit limit use it judiciously each month making sure to pay off the full balance EVERY month. Over time you may be able to secure a credit card with more favorable rates and lower fees. Plot when you wish to finance some furniture or a vehicle. Begin tracking your credit score realizing it moves up much slower than it moves down.

POOR Credit Score

Yikes! You have a “poor” credit score. Don’t panic. Talk to your creditors. Establish payment plans to which you can adhere. Attack the smallest balances first and pay them off then take that money and add it to another balance and get that one paid off. Continue doing that until you get ALL of your credit cards paid. Making timely payments will begin to right the ship. Do not take on additional credit or debt. Attack your credit score from all angles, better payments, less cards, and fewer inquiries! If you are renting, see if the company you are renting from will sign up with ACUTRAQ Background Screening Inc. By signing up with ACUTRAQ they may qualify to report your on-time rental payments to the bureau. As time passes and you adhere to your resolve you should see your score rise to “fair” and then to “good” and eventually to “GREAT”.